INTRODUCTION / RESEARCH

According to a study by Schufa Holding AG from the year 2020, about 41 percent of Germans have difficulties controlling their expenses and end up spending more than they can afford. Another study by the Statistisches Bundesamt (Federal Statistical Office) from 2019 reveals that approximately 18 percent of Germans struggle to keep their monthly fixed costs under control.

Furthermore, a survey conducted by the Deutsches Institut für Wirtschaftsforschung (German Institute for Economic Research) in 2017 found that more than half of German households lack formal budget planning, leading to difficulties in managing their expenses effectively.

These statistics demonstrate that many people indeed face challenges in maintaining an overview of their finances, especially concerning their monthly fixed costs. Therefore, it is crucial for individuals to develop awareness of their financial situation and make efforts to control their spending in order to improve their financial well-being.

Financial apps – household apps for cost management – are often linked to other products, charge fees, and come with a lot of advertisements. Service providers such as the Employment Office or debt advisors usually do not refer to assistance with such products.

PROBLEMSTATEMENT

One reason why people get into debt is often the lack of overview regarding their monthly fixed costs. Hundreds of services offer subscription-based memberships, making it easy to lose track.

Fortunately, there are financial apps and thousands of tools available for liquidity planning, especially for businesses. However, in the private sector, there is a lack of simply organized apps. Moreover, most digital tools are tied to insurance companies or banks. When asking private individuals about their monthly fixed costs, only a few can provide accurate information. The loss of overview of fixed costs is a primary reason why individuals make poor financial decisions. It is these fixed costs that influence liquidity and financial decisions.

Monthly fluctuating costs also play a role, as well as having an overview of subscriptions and annual fees.

Digital household books are sometimes very complex, but what is needed, especially for socially and economically disadvantaged individuals, is an incredibly simple solution that helps them learn to handle money, make better financial decisions, and avoid living beyond their means.

Almost everyone has a phone, and fewer people use PCs to create their own financial statements. People want to do their entire tax returns using their phones, so there is a need for a simple mobile overview of fixed costs that:

- Has a straightforward structure

- Allows easy data entry (voice-over may require time)

- Provides a very simple overview

- Offers good usability with voice control

- Does not have too many features

REALIZATION

In most projects, I start with paper and pen. I quickly jot down initial ideas and

sketch out the first visual elements. Here are some rare examples:

QUICK NOTES / USER-PERSONA

SKETCHES

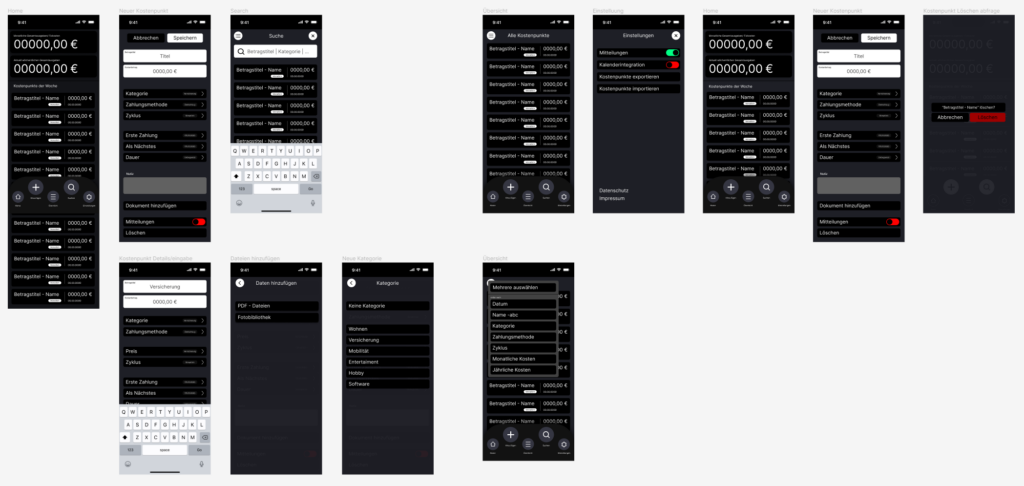

Once the concept is established, I transition to the software and create a simple, initial scalable design system, along with the corresponding first components. After that, I attempt to recreate all the relevant screens. Once the prototype is complete, I proceed with the first user flows.

FIGMA PROTOTYPE

In case the embeded prototyp dosn´t work, go directly to figma.